The Bezos Flywheel: The #2 Mental Model That Has Helped Me Succeed As A Thought Leader

One question Jeff Bezos was often asked when he was the CEO of Amazon was one we all need to ask ourselves…

What’s going to change in the next 10 years?

It’s a profound question because the world is changing so rapidly and because the decisions we make now determine our destiny.

Decide wrong and you might find yourself on a sinking ship, watching as your whole industry goes bankrupt and the skills you spent years honing become obsolete. Millions of people from journalists to financial analysts now find themselves in this position.

Decide right and you could be set for life. The top artificial intelligence programmers, for example, make as much as NFL superstars. These programmers have suddenly found that the skill set they spent years honing has become incredibly valuable.

These two groups, top AI programmers and people whose skills have become devalued, might have spent the same amount of time learning and be equally smart. But selecting different fields took them down completely different paths.

The same phenomenon happens in the world of thought leadership. There are people now working in thought leadership whose knowledge is becoming less and less valuable, and it’s becoming harder and harder for them to stay relevant whereas there are others who are receiving more and more recognition, opportunities, and internal enjoyment.

Many of the differences between the two groups comes down to how they answer the Jeff Bezos question regarding what’s going to change in the next 10 years.

In this article, I’ll share a mental model I learned from Jeff Bezos that has changed my life, and I regard it as the second-most impactful mental model of those I’ve explored for the internal enjoyment and external success I’ve had as a thought leader (just behind the blockbuster mental model).

Let’s start with this…

‘What’s Going to Change?’ Is The Wrong Question

As I noted above, Jeff Bezos is often asked, “What’s going to change in the next 10 years?” That’s actually not the key question though. Listen to how he reframes it (emphasis mine):

That is a very interesting question; it’s a very common one. I almost never get the question: ‘What’s NOT going to change in the next 10 years?’

And I submit to you that that second question is actually the more important of the two — because you can build a business strategy around the things that are stable in time.

He then goes on to explain how Amazon has profited from focusing on the second question (emphasis mine):

[I]n our retail business, we know that customers want low prices, and I know that’s going to be true 10 years from now. They want fast delivery; they want vast selection. It’s impossible to imagine a future 10 years from now where a customer comes up and says, ‘Jeff, I love Amazon; I just wish the prices were a little higher,’ [or] ‘I love Amazon; I just wish you’d deliver a little more slowly.’ Impossible.

And so the effort we put into those things, spinning those things up, we know the energy we put into it today will still be paying off dividends for our customers 10 years from now. When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.

I remember the thoughts running through my head the first time I read this quote. It felt intuitive and counterintuitive at the same time. On the one hand, I thought:

This makes so much sense! Why not just focus on what’s guaranteed to be valuable rather than speculating?

On the other hand, Bezos’ response flies in the face of conventional wisdom and was jarring. The typical approach to planning for the future resembles betting at the roulette wheel:

Identify what you think is going to be really important (i.e., artificial intelligence, virtual reality, blockchain, synthetic biology, nanotechnology).

Pick one of those areas to invest in and master it.

Hope it hits big and that you have the right timing so that you can profit.

While the conventional approach does sometimes work, it’s not a dependable strategy. It’s not what I’d tell my kids to do. For example, a 2012 study from the Kauffman Foundation shows that “The [venture capital] industry hasn’t returned the cash invested since 1997.” And if you take out a few companies like Uber, Amazon, Google, and Facebook, the returns are abysmal.

Why doesn’t focusing on trends work as well as you might think?

Before I jump into that question, I just want give you more context on the outline of today’s post, so you have a map of where we’re going…

Today’s Game Plan

For Free Subscribers

Why future prediction doesn’t work for most people. According to self-made billionaire investor Howard Marks. His principles on financial investing have really helped me become a better investor of my time.

The Flywheel Mental Model explained by its Stanford creator. I distill and break down The Flywheel concept using the clips and quotes by Jim Collins, the creator of the idea.

How Jeff Bezos used The Flywheel to help Amazon succeed. 20 years after Amazon adopted the flywheel, it’s virtually impossible for other online retailers to compete head-on. I share this case study to demonstrate the power of this idea, when executed well.

For Paid Subscribers

How the mental model of the flywheel can transform your thought leadership. I have never seen a systematic application of how one could apply the Flywheel mental model to thought leadership, so I created one from scratch.

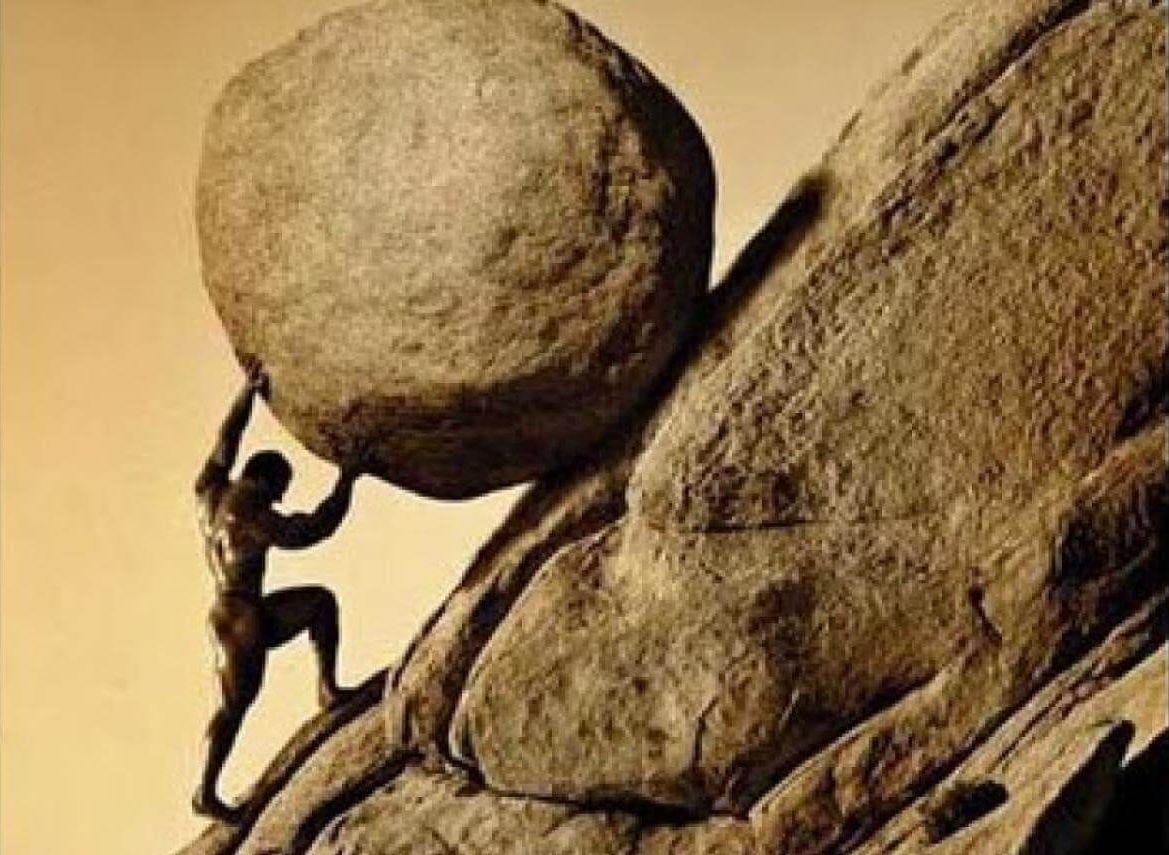

Personal case study: How the Flywheel transformed my approach to thought leadership. As is often the case, I discovered what works by first discovering what doesn’t. In my previous business, it felt like pushing a boulder up the hill, gaining momentum only to lose it. With thought leadership, I want to create a process with compounding momentum.

Steps to apply The Flywheel to your thought leadership. I share the 6 pillars I developed for my flywheel.

7 tips from Jim Colins. At the end, I share Jim Collins’ 7 tips to build a flywheel that you can use to create your own flywheel.

Why Future Prediction Doesn’t Work For Most People

You can’t predict, you can prepare.

—Howard Marks

Self-made billionaire, entrepreneur, and investor Howard Marks runs the investment firm Oaktree Capital and has $100 billion under management, making it one of the largest hedge funds in the world. Each year, Marks writes a widely-circulated letter to shareholders. One of these memos gives a masterclass on how investing in future trends isn’t always smart:

The seemingly sure bets will have the most competition, which will make them less profitable. Marks writes: “Most great investments begin in discomfort. The things most people feel good about — investments where the underlying premise is widely accepted, the recent performance has been positive and the outlook is rosy — are unlikely to be available at bargain prices. Rather, bargains are usually found among things that are controversial, that people are pessimistic about, and that have been performing badly of late.”

Luck and randomness are big, unavoidable factors. “It’s far from certain that even the ‘right’ decisions will be successful because every decision requires assumptions about what the future will look like, and even reasonable assumptions can be thwarted by the world’s randomness,” says Marks. There are certain random events that are so influential that they completely change the game for everyone. Nassim Taleb calls these events “Black Swans.” (A great example is the 2008 financial crisis.)

It’s much harder than you think to be consistently right. “It’s hard to consistently make decisions that correctly factor in all of the relevant facts and considerations (i.e., it’s hard to be right),” Marks notes with humility, a key trait of many of the world’s top-performing investors. Self-made billionaire Ray Dalio, the founder of the largest hedge fund in the world, drives home how hard investing is in the first sentence of his new book: “Before I begin telling you what I think, I want to establish that I’m a ‘dumb shit’ who doesn’t know much relative to what I need to know.”

Even if you get the prediction right, you are likely to get the timing wrong. Marks says: “Even well-founded decisions that eventually turn out to be right are unlikely to do so promptly. This is because not only are future events uncertain, their timing is particularly variable.” And the problem with this is that getting the timing wrong is functionally equivalent to making the wrong decision.

The field of artificial intelligence is a case in point for Marks’ argument. While artificial intelligence sounds like a sure bet now, it wasn’t always that way. From 1974–1980 and 1987–1993, the field went through “AI winters.” During these periods, AI reeled from being overhyped and lost credibility and funding. Talented young programmers left in droves. Many of the most successful people in the field now are those who survived these winters and kept going even when it didn’t seem smart to do so and all of their mentors told them to leave the field. Now, someone entering the AI field has to compete against droves of the smartest people in the world.

My point is that picking which fields will be hot in 20 years is not as simple as it sounds. Predicting third-, fourth-, and fifth-order consequences is almost impossible. Who would’ve predicted in the early 1900s that the invention of the automobile would ultimately lead to the creation of suburban sprawl, the hotel industry (because of the Interstate Highway System), and the insurance industry?

Notice how Warren Buffett, the best investor in history, doesn’t invest in the hottest tech startups of the day. Instead, he has made his career by identifying businesses whose rock-solid fundamentals don’t change or change very slowly. As a result, Buffett is able to invest in companies for the long term. He’s held stock in companies like Geico, Coca-Cola, and American Express for decades.

So if predicting the future isn’t the answer for most people, what can you do instead?

To answer this question, we can return to a mental model Jeff Bezos learned from a Stanford researcher that changed the trajectory for Amazon…

The Flywheel Mental Model Explained By Its Stanford Creator

One of the most powerful ideas in the world of business is the flywheel. Famed business researcher Jim Collins introduced this mental model in his mega-bestselling book, Good To Great, which studies some of the most successful companies in the world over a multi-decade period.

A flywheel is a mechanical device that takes a huge amount of effort to turn at first. But once it starts, its weight creates its own momentum. Turning the flywheel becomes easier and easier at the same time that it becomes faster and faster.

A big insight that comes from the flywheel metaphor is how success happens over time. From the outside, it seems like it happens overnight. But, when you look at success from the inside, it’s a gradual compounding process like a flywheel.

Collins explains in Turning The Flywheel:

In creating a good-to-great transformation, there’s no single defining action, no grand program, no single killer innovation, no solitary lucky break, no miracle moment. Rather, it feels like turning a giant, heavy flywheel.

—Jim Collins

He also shares a brief anecdote that illustrates the concept in one of his YouTube videos:

Source: Jim Collins Explains The Concept Of The Flywheel

Putting it all together, here’s what the conceptual visual of the flywheel looks like…

After years of studying great companies, Collins had found that they all had metaphorical “flywheels” at the center of their business:

For a truly great company, the Big Thing is never any specific line of business or product or idea or invention. The Big Thing is your underlying flywheel architecture, properly conceived.

—Jim Collins

After conducting a quarter-century of research into the question of what makes great companies tick—more than six thousand years of combined corporate history in the research database—we can issue a clear verdict. The big winners are those who take a flywheel from ten turns to a billion turns rather than crank through ten turns, start over with a new flywheel, push it to ten turns, only to divert energy into yet another new flywheel, then another and another. When you reach a hundred turns on a flywheel, go for a thousand turns, then ten thousand, then a million, then ten million, and keep going until (and unless) you make a conscious decision to abandon that flywheel. Exit definitively or renew obsessively, but never—ever—neglect your flywheel. Apply your creativity and discipline to each and every turn with as much intensity as when you cranked out your first turns on the flywheel, nonstop, relentlessly, ever building momentum. If you do this, your organization will be much more likely to stay out of How the Mighty Fall and earn a place amongst those rare few that not only make the leap from good to great but also become built to last.

—Jim Collins

And, of all of the concepts that Collins shared in Good To Great, the flywheel mental model was so useful and universal that he wrote an entire other book on just implementing the flywheel. Explaining the universality of the model, Collins says:

You’ll find the flywheel effect in social movements and sports dynasties. You’ll find the flywheel effect in monster rock bands and the greatest movie directors. You’ll find the flywheel effect in winning election campaigns and Victorious military campaigns. You’ll find the flywheel effect in the most successful long—term investors and in the most impactful philanthropists. You’ll find the flywheel effect in the most respected journalists and the most widely read authors. Look closely at any truly sustained great enterprise and you’ll likely find a flywheel at work, though it might be hard to discern at first.

—Jim Collins

Amazon is the ultimate example of how to use the flywheel concept to succeed in a complex, rapidly-evolving environment…

How Jeff Bezos Used The Flywheel To Help Amazon Succeed

Intrigued by the flywheel concept in Good To Great, Bezos hired Collins to lead an Amazon executive retreat early in Amazon’s history where Collins coached the team on how to use the flywheel.

To determine the elements of Amazon’s flywheel, Bezos identified the pillars that would NEVER change. Those pillars were:

Low prices

Selection

Fast shipping (added later)

And he also chose the pillars because they were synergistic with each other:

Low prices increased customer visits

Which attracted more third-party sellers

This expands the size of the store

Which led to higher gross revenues per fixed cost

Which meant that Amazon could lower prices anymore

This dynamic of constantly increasing profitably and then investing that profit in lowering the price is why Bezos famously said, “Your margin is my opportunity.”

Collins explains the importance of these steps in the video below…

Source: Jim Collins: Turning the Flywheel -- Underlying Logic

Here’s how these pillars play into Amazon’s original flywheel:

Notice two things:

The importance of the pillars hasn’t changed. Low price, selection, and fast shipping are just as important to Amazon 20 years later. People in the future didn’t suddenly want higher prices, less selection, and slower shipping.

The pillars increased over time via compounding. Because Bezos knew that the pillars would be important for decades, he felt comfortable investing billions of dollars even though it meant being unprofitable for decades. Long-term thinking is critical to the flywheel. Jim Collins explains why: “You need to stay with a flywheel long enough to get its full compounding effect.”

Today, 20 years after Amazon adopted the flywheel, it’s virtually impossible for other online retailers to compete head-on.

This all begs the question…

How does the mental model of the flywheel apply to thought leadership?

Personal Case Study: How The Flywheel Transformed My Approach To Thought Leadership

The flywheel was immediately inspirational for me.

It felt this way because I knew what it was like not to have one.

In my previous business, it felt like this…

And this…

More specifically:

We had to constantly push a boulder up the hill in order to grow and sustain our business.

While we had momentum sometimes, we often lost it. We weren’t able to maintain it.

When the business ultimately shut down, I felt like I didn’t have much to show for it, and I had sacrificed my personal growth, and learning in order to optimize for business growth.

I wanted my thought leadership journey to be different.

I wanted it to feel like pushing a boulder down the hill rather than up as I gained more and more momentum. And, I wanted to build up more and more ‘assets’ (knowledge, skills, reputation) so that I would have more and more options as time went by. And finally, I wanted to put me first.

Said differently, I wanted it to feel like this…

At the same time, applying the flywheel to thought leadership was not easy. There was not an easy drag-and-drop template I could use. So I had to build it from scratch using first principles.

Along the way, I made many mistakes, but over time I’ve developed a flywheel that is incredibly powerful.

In the end, I followed the steps below…