8 Things That Self-Made Billionaires Do Differently

Author’s Note: This article was written over 60 hours with love and care using the blockbuster mental model.

Is there some unique way of thinking that gives self-made billionaire entrepreneurs an edge?

Fascinated by this question for my whole career as a serial entrepreneur and writer, I’ve read more billionaire entrepreneur biographies than I can count, researched what they have in common, and met and interviewed several.

Without a doubt, luck plays a central role. But luck alone doesn’t explain the repeated success of entrepreneurs who create billion-dollar company after billion-dollar company or who have enduring multibillion-dollar companies: entrepreneurs like Warren Buffett, Jeff Bezos, Steve Jobs, and Elon Musk.

By researching these entrepreneurs, I’ve found unique ways of thinking that aren’t commonly known among most entrepreneurs (even successful ones).

The process of uncovering these principles has fundamentally changed how I think about business (and life). Some have served as a reminder that it’s consistently doing simple things that matter most.

For each entrepreneur I studied, I’ve uncovered a:

Billionaire entrepreneur strategy. The overarching principle that has served as a foundation for the billionaire’s success. I focused on one specific, non-obvious strategy.

Billionaire entrepreneur hack. How successful entrepreneurs are applying the strategies to grow their business.

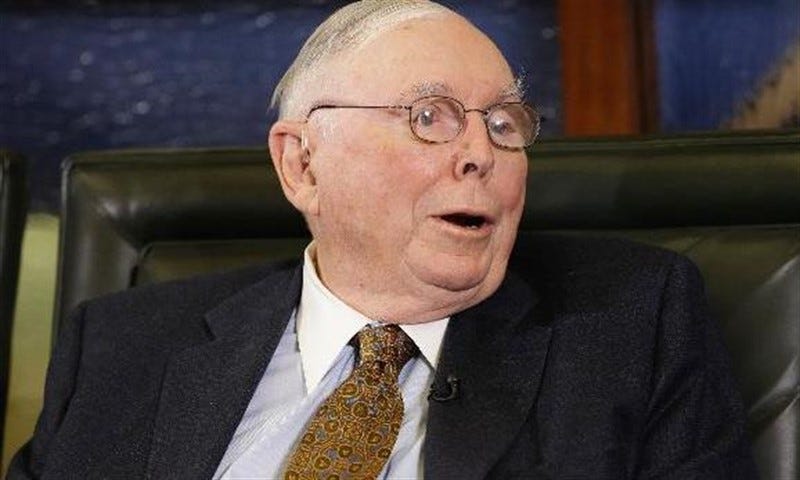

1. Charlie Munger (billionaire investor): Analyze what can go wrong instead of what can go right.

Billionaire Entrepreneur Strategy:

Until I read billionaire Charlie Munger’s Poor Charlie’s Almanack, I thought the key to success was creating a vision, setting goals, and working hard toward them every day.

If I failed, I thought it was because I did one of these steps wrong.

Charlie Munger, Berkshire Hathaway vice chairman and long-time Warren Buffett business partner, shows another equally important path to success; thinking through what can go wrong.

Things constantly go wrong no matter how smart and hardworking you are.

Realizing this, Munger continuously and methodically considers every way a plan could go wrong and plots out how to avoid each obstacle. He says:

Invert, always invert: Turn a situation or problem upside down. Look at it backward. What happens if all our plans go wrong? Where don’t we want to go, and how do you get there? Instead of looking for success, make a list of how to fail instead—through sloth, envy, resentment, self-pity, entitlement, all the mental habits of self-defeat. Avoid these qualities and you will succeed. Tell me where I’m going to die so I don’t go there.

Munger’s approach helps him avoid roadblocks and be more prepared when he inevitably runs into one. Furthermore, combining goal setting and obstacle avoidance is backed up by a growing body of over 100+ academic studies on the topic. When people only ‘fantasize’ about the future, they actually end up taking less action than they would if they also thought about what could go wrong and made plans to avoid it.

Bottom line: Being both pessimistic and optimistic is better than just being optimistic. One of the best ways to win is not to lose.

Billionaire Entrepreneur Hack:

To apply this principle, test your plan with this three-step premortem process developed by Meathead Movers CEO and co-founder, Aaron Steed:

List the ways the project could fail

Assign a probability to each possibility

Prioritize actions that can be taken to avoid failure

Steed created the process after noticing that certain projects at his 350-person company were getting poor results.

Rather than adding new procedures to help those projects succeed, he developed the premortem process to remove the barriers that were causing them to fail.

One of the obstacles that Munger proactively avoids is psychological biases. As an additional resource, we compiled a 27 page report that summarizes the 22 psychological biases that Munger has identified throughout his 70-year career.

2. Warren Buffett (billionaire investor): Use checklists to avoid stupid mistakes.

Billionaire Entrepreneur Strategy:

Generally speaking, there are two types of mistakes: those that are stupid and those that are ignorant.

Ignorant mistakes happen when you don’t know better. Stupid mistakes happen when you do know better.

Stupid mistakes are the hardest to stomach because they’re the easiest to solve. Yet people, especially smart people, make them over and over.

Warren Buffett and his 40-year business partner, Charlie Munger, don’t attribute their success to raw intelligence or brilliant ideas. Instead, they attribute a large part of it to consistently avoiding stupid mistakes by religiously following basic tenets and ideas they know will work.

Talking about his and Buffett’s strategy in his book, Munger states:

We try more to profit from always remembering the obvious than from grasping the esoteric.

To counteract the often negative influence emotions can have on investment decisions, Buffett and Munger use several checklists, including ones for investing, problem-solving, and psychological biases.

They claim that using these checklists has been crucial to their miraculous 21.6 percent return on investment for four decades, which is double the market average.

More recently, checklists have been receiving well-deserved attention as a result of the Checklist Manifesto, written by Harvard Medical School professor of surgery, Atul Gawande.

In a fascinating study by the World Health Organization, 8 hospitals that adopted a 19-point checklist saw deaths from surgery nearly cut in half!

Billionaire Entrepreneur Hack:

Blake Goodwine has used a decision-making checklist to build his Lionize Media Group into a network of niche media sites with tens of millions of monthly visitors.

His problem-solving checklist, shown below, lays out the path to a successful business strategy, and counteracts any internal biases that impede him from reaching his desired destination:

Brainstorm. Dream up as many possible solutions as you can. This helps you avoid availability bias, which often results in us choosing the first solution that comes to mind rather than the best solution.

Test. Test as many potential solutions as you can afford to. This avoids the confirmation bias of rationalizing the one solution you chose.

Evaluate. Have a minimum success criteria for each experiment. This allows you to avoid doubling down on bad ideas that aren’t working in an effort to recoup sunk costs.

Learn. Dive deeply into the data and learn from EVERY experiment, not just the one that worked best. Avoid taking mistakes personally and feeling shame over something that did not work.

Even if this checklist helps you make big decisions just slightly better, it will change the entire trajectory of your life and business. It has for me.

—Blake Goodwine

As an additional resource, we compiled some of the best expert advice on how to create actionable checklists into a step-by-step guide.

3. Ray Dalio (billionaire investor): Learn how to think independently so you can be smarter than everyone else.

Billionaire Entrepreneur Strategy:

“You can’t make money agreeing with the consensus view,” asserts Ray Dalio, founder of Bridgewater Associates, the largest hedge fund in the world ($169+ billion under management).

Doing what everyone else does is going to bring you average results. That’s the definition of average.

To Dalio, the key to having enduring, extraordinary performance is to do what others won’t or can’t AND to be right.

This is easier said than done. For example, 86% of professional investors do not beat the market. The numbers are sobering for entrepreneurship too: 30.9–37.6% of new businesses fail in the first three years.

In a recent op-ed, Dalio explains why it’s so hard:

Whenever you’re betting against the consensus there’s a significant probability you’re going to be wrong, so you have to be humble.

The good news is that with enough practice, you can put the odds in your favor.

Billionaire Entrepreneur Hack:

Thinking independently is more than one simple hack. Broadly speaking, it requires: